Your MarTech stack captures a lot of data about campaign activity and engagement. The metrics for sends, opens, and click-through rates are comforting, especially when engagement ticks up.

But here’s the uncomfortable truth most marketers feel and rarely name: engagement alone is not an indicator of consumer purchase readiness. And that’s because most MarTech stacks are configured to measure what you did, not what consumers do as they move toward a purchase.

That’s not just a reporting gap. It’s a strategic blind spot — frustrating, and potentially dangerous if ignored.

This disconnect shows up in subtle but costly ways. Budgets get optimized around vanity metrics instead of real consumer intent. Messages arrive too early or too late.

Personalization looks precise on paper but feels off to the person receiving it.

When marketers are attuned to consumer purchase readiness, decision-making feels clearer and more confident. When they’re not, the consumer buying journey becomes a black box of missed revenue opportunities.

What is purchase readiness?

Purchase readiness isn't a funnel stage. It's a behavioral state that forms and fades based on real-time insights — and it often changes faster than most MarTech stacks are designed to observe.

It becomes visible when consumer behavior shifts from broad exploration to focused evaluation. Signals like increased browse depth within a category, repeated interaction with the same products, comparison behavior, and compressed return visits indicate momentum toward a decision. These patterns reflect readiness forming, but they rarely surface in campaign-level reporting because data is scattered across email, web, mobile, product, and ecommerce/CRM systems that require manual stitching or custom integrations.

Marketing programs that rely on daily or weekly data processing cycles managed by IT or analytics teams struggle here. Not because the behavioral signals don’t exist, but because existing MarTech stacks weren’t designed to interpret them in real time. By the time insights arrive, the moment to act has passed.

How vanity metrics hide intent

A vanity metric is a data point that reflects marketing activity, but it's usually superficial and doesn't indicate whether a consumer moved closer to a purchase.

In an Intent-Driven Marketing model, that distinction is the whole point: intent isn't inferred from campaign interaction — it's derived from behavioral signals tied to decision-making: product-level browsing patterns, category focus, comparison behavior, return frequency, and shifts in cart composition. These signals describe where someone is in their buying process — not where they sit in a campaign calendar.

Engagement metrics reduce those distinct behaviors to surface-level metrics that hide what's actually driving purchase decisions. Recent opens and clicks are treated as indicators of interest regardless of what happens beyond the message itself.

The problem compounds when engagement data is used to define lifecycle stages. “Active” and “at-risk” labels are often assigned based on recent interactions with campaigns rather than changes in buying behavior. That approach assumes silence equals disengagement, and activity equals intent — assumptions that routinely break down in retail and ecommerce environments.

Over time, lifecycle stages built on engagement data drift away from consumer reality. Consumers who are actively purchasing elsewhere may be flagged as dormant. Others who consistently interact with messages but show no buying momentum remain classified as high value. Every automation triggered from those stages sends the wrong message to the wrong person — and does it consistently enough to feel intentional to the consumer.

Why engagement-based personalization breaks down in the funnel

The consideration stage is where this disconnect becomes most costly. Many marketers treat it as a holding phase where prospects wait to be nurtured forward. In reality, readiness can intensify and disappear quickly, sometimes within a single visit or a short window across sessions. And this is exactly where personalization and funnel performance start to fall apart.

When personalization is built on engagement data, it creates the appearance of relevance without matching consumer intent. Segments based on campaign interaction inevitably combine different levels of interest, different purchase contexts, and different motivations. The message looks right on your end, but the consumer sees something that has nothing to do with what they're actually evaluating.

Standard funnel analysis can't diagnose the problem. It tracks conversion milestones — add to cart, checkout start, and purchase completion — but it doesn't explain why many consumers never reach those milestones despite repeated interaction earlier in the journey.

Without visibility into decision-stage behavior, marketers can't see where confidence stalled, where options failed to differentiate, or where messaging arrived out of sync with intent.

The cost accumulates quietly. Personalization that misses erodes relevance. Discounts applied without understanding readiness erode margin. Lifecycle messaging based on misclassified stages erodes trust. None of this is obvious in engagement reports — but all of it affects revenue.

What it takes to see purchase readiness clearly

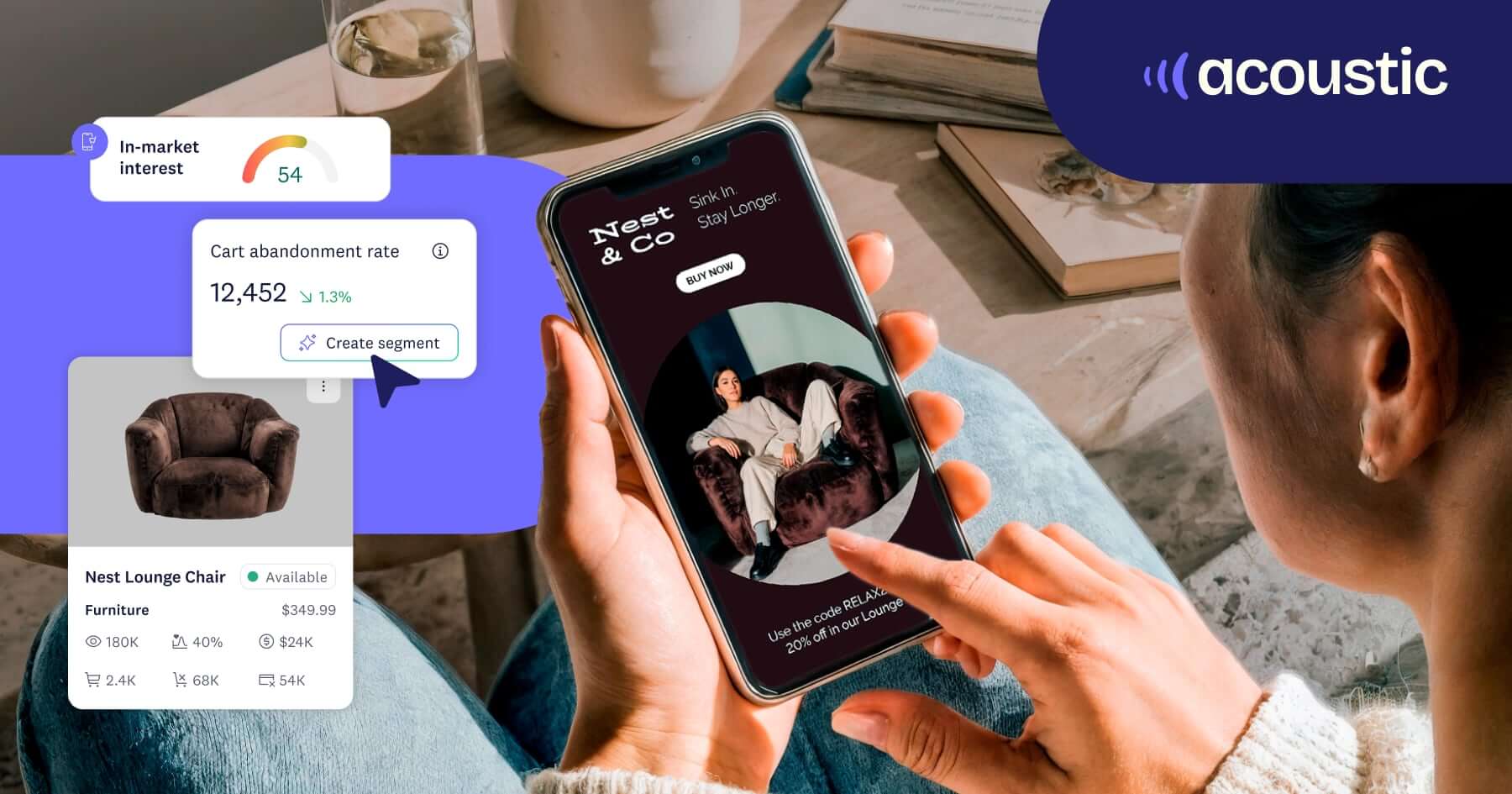

Purchase readiness isn't hidden. It's simply not visible in systems designed to report on campaigns instead of consumer behavior. The solution isn't just more data or better dashboards bolted onto existing tools; it’s a platform that’s built on native, first-party behavior data.

When targeting, messaging, and timing decisions are informed by real-time behavioral insights instead of engagement alone, intent becomes visible. And when intent is visible, marketing can finally act with confidence — not after the moment has passed, but while it still matters.

Learn how Acoustic Connect reveals purchase readiness through native, first-party behavior data.